Ethanol, widely known as a biofuel, has a growing presence

in the chemical industry. In itself, ethanol is a low volume speciality

chemical with various uses as a solvent, but with a single chemical transformation

it is readily transformed to ethylene, the largest volume chemical intermediate

in the world.

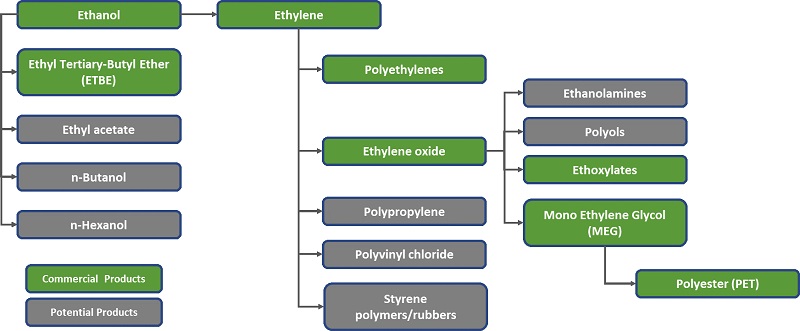

Passing ethanol over an alumina or zeolite catalyst produces

high purity ethylene in high yields, allowing the production of derivatives

including high and low density polyethylenes, PVC, PET and ethoxylates. The

ethylene value chain represents an annual production volume of over 130 million

tonnes and a global market forecast to be valued at almost $250billion by the

end of the decade.

Traditionally produced from petrochemical naphtha, the

biggest consumers of ethylene are the polyethlyenes (high density, low density

and linear low density). They are also the largest consumers of biobased

ethylene. The Brazilian chemical giant Braskem has been producing biobased

polyethylene from sugarcane-derived ethanol since 2007. In 2010, Braskem inaugurated

its 200,000tons per year biobased ethylene plant in Triunfo, Rio Grande do Sul.

The Braskem product line, marketed under the ‘I’m Green™’ brand, includes high-density,

low-density and linear-low-density polyethylene, for rigid packaging

applications, films, caps and closures, and bags. Braskem’s biobased

polyethylene has been used as a 3D printer filament aboard the international

space station, with the first printed item being a pipe connector for a

vegetable irrigation system.

Braskem also uses ethanol in the production of Ethyl

Tertiary-Butyl Ether (ETBE), and has developed an ethylene based metathesis

route to polypropylene (which they have yet to commercialise).

Ethanol is the key intermediate in the production of

biobased polyethylene terephthalate (PET) plastic. PET is produced from

monoethylene glycol (MEG) and terephthalic acid: dehydration of ethanol to

ethylene is followed by conversion to ethylene oxide, and finally MEG. This

process provides a route to PET with a 30% biobased content. The PET market is

not only large - over 70million tons of PET is used as plastic resin and

textile filament - but is also a consumer touch point for the biobased

chemicals industry. Plastic bottles are commonly produced from PET and with

iconic brands such as Coca Cola, Heinz and Pepsi looking for new opportunities

to demonstrate their sustainable credentials the potential for biobased PET has

not been overlooked. Under the PlantBottle® brand Coca Cola have distributed

over 35 billion packages and have the ambition to convert all new PET plastic

bottles, to PlantBottle packaging (up to 30% plant-based) by 2020.

In 2012, Coca-Cola, Ford, H.J. Heinz, NIKE and Procter &

Gamble announced the formation of the Plant PET Technology Collaborative (PTC),

a strategic working group focused on accelerating the development and use of

100% plant-based PET materials and fibre in their products. There are numerous

companies - including the chemical giants BASF - who have formed a joint

venture with Dutch technology developer Avantium, working towards the

production of 100% biobased PET or its analogue PEF. Commercial production

could be realised by 2020.

Ethylene oxide also has important derivatives beyond

monoethylene glycol. It is used to produce ethoxylates, chemicals with a wide

range of applications in many sectors, including cleaning products, cosmetics,

and paints. Although many ethoxylates are partially biobased, being produced

from fatty acids, the lack of access to biobased ethylene oxide has prevented

the sale of 100% biobased ethoxylates.

Thanks to the UK speciality chemical ingredients company

Croda, the situation is now changing.

Croda is a company rooted in the production of high performance chemicals from renewable resources. Founded in 1925, the company’s first product was lanolin, the refined form of wool grease, a product still widely used today across health, personal and industrial sectors. Over the subsequent nine decades Croda has grown into a £1billion business.

For Croda, the high performance of their ingredients is

paramount and goes hand in hand with their longstanding commitment to investing

in sustainability and putting innovation into action. This commitment and drive

has resulted in the company having an impressive 70% of its raw materials derived

from renewable sources.

In 2015, Croda began work on a $170million project at its

Atlas Point manufacturing site in New Castle, Delaware. Their aim was to produce

biobased ethylene oxide as basis for their ethoxylate product range. The

project has now come to fruition with the plant successfully up and running,

and later in 2017 Croda will release a full range of 100% biobased ethoxylates.

Although “Greener”, non-ethoxylated ingredients, have been

used in the development of more natural formulations, many in the industry feel

the performance has not yet met the levels of the traditional ethoxylates.

According to Croda the 100% Bio-based ECO Range of ingredients will enable its

customers to meet their goals of delivering 100% renewable, high-performance

products to their consumers and reduce the reliance on fossil fuels. Croda’s

Bio-based ECO range will contain more than 60 different ingredients, making it

the widest range in the industry. Additionally, Croda will also produce a

non-ECO branded range of products, not attaining 100% biobased content, but having

a highly improved biobased profile over traditional versions.

Croda is a participant in the USDA’s BioPreferred program,

and through the program are supporting the uptake of biobased products. Many of

Croda’s products are among the 2,500 products, in 100 different product

categories, certified by the program and the ECO range is expected to join this

list. Their achievements have been recognised by their receiving the award for

“Most Innovative Use of Green Chemistry” from the New York Society of Cosmetic

Chemists for their biobased ethoxylate development.

The next addition to ethanol derivatives family is likely to

be ethyl acetate. Through its subsidiary Prairie Catalytic, the renewable

che

micals company Greenyug is targeting the $4 Billion ethyl acetate market. The

Prairie Catalytic production facility will be located next to Archer Daniels

Midland Company's (ADM) Corn Processing Plant in Columbus, Nebraska, with ADM supplying

the project with bioethanol feedstock and other services. Construction of the

50,000ton facility is anticipated to start during 2017 with production set to

begin in 2018.

Without doubt the political drive to develop biofuels such

as ethanol has created an industrial base from which the biobased chemical

industry can grow. As with the petrochemical industry, fuel may create the

volume but chemicals offer the value, and we are likely to see further strings

added to ethanol’s bow in the future. However, these chemical projects remain

large scale investments and are not without risk, with this in mind and staying

with the archery theme we should complement companies like Croda and allow them

the honour of wearing the proverbial feather in their cap.