Ammonia II – Green ammonia

Emma Lewis

Researcher

This article explores the differences between conventional and green ammonia and discusses the applications and benefits of ammonia as fertiliser and shipping fuel.

For all living organisms, nitrogen (N) is one of the building blocks of the amino acids which make up proteins and enable metabolic function. More specifically, in plants, N is involved in the production of chlorophyll – the green pigment that makes photosynthesis possible and enables the conversion of solar energy into the chemical energy that is essential to the survival of plants1 Mosaic. Nitrogen – Nitrogen in plants. Online. [https://www.cropnutrition.com/nutrient-management/nitrogen].

Plants can acquire N through the uptake of ammonium (NH4 + ) or nitrate (NO3 – ) in soils and water, with species preferring one form to the other depending on their N uptake mechanisms and adaptations2Maathuis FJM. 2009. Physiological functions of mineral macronutrients. Current Opinion in Plant Biology 12(3): 250-258. These two main compounds are made available in soils thanks to the process of nitrogen fixation. Nitrogen fixation, defined as the combination of atmospheric nitrogen (N2) with other elements to form more reactive compounds that plants can uptake from their root systems, may occur in two different ways: when lightning strikes, providing sufficient energy for a reaction between nitrogen and oxygen to produce nitrogen oxide and nitrogen dioxide; and when diazotrophic soil bacteria fix nitrogen into ammonia, nitrites, and nitrates, while often forming a symbiotic relationship with the plant. The latter provides most of the “fixed nitrogen” in soils3Aczel MR. 2019. What Is the Nitrogen Cycle and Why Is It Key to Life? Frontiers for Young Minds 7(41). Online. [https://spiral.imperial.ac.uk/bitstream/10044/1/71039/5/frym-07-00041%20%281%29.pdf] . The fixed N then provides the basis of the entire N cycle which benefits all living organisms on the planet.

As a result of the increasing need for food production, contemporary agricultural practices favour the use of products which increase soil nutrient content, so that crops can access sufficient nutrients and grow fast, big and nutritious. N-fertilisers are designed to increase the content of immobilised N in the soil in the form of ammonium or nitrate (and sometimes nitrites). Fertilisers, including nitrogen fertilisers, have become ubiquitous. According to the IPCC, their use has risen by 800% since the 1960s4 IPCC. 2019. Special report on Climate Change and Land. Online. [https://www.ipcc.ch/srccl/] . Further increase is expected in the next years, and decades, with the global N-fertiliser market projected to amount to around $125 billion by the end of 20225Markets and Markets. Nitrogenous Fertilizers Market by Type (Urea, Ammonium Nitrate, Ammonium Sulfate, and Calcium Ammonium Nitrate), Form (Liquid and Dry), Mode of Application (Soil, Foliar, and Fertigation), Crop Type, and Region – Global Forecast to 2022. Online. [https://www.marketsandmarkets.com/Market-Reports/nitrogenous-fertilizers-market243341881.html#:~:text=The%20nitrogenous%20fertilizers%20market%20was,USD%20126.96%20billion%20by%202022.]. In this article we look at the production pathways for the manufacture of ammonia destined for Nfertilisers. We compare conventional fossil-derived ammonia and sustainably produced “green ammonia”, and their respective markets. We also look at the use of “green ammonia” as a potential biofuel for maritime shipping.

Conventional fossil-derived ammonia

Historically, the production of conventional ammonia was achieved by heating a mixture of nitrogen and oxygen, commonly air, to high temperatures to form a small amount of nitrogen oxide, which was extracted for fertiliser use, or by reacting nitrogen with calcium carbide to make calcium cyanamide, which is further processed into ammonia and urea6 Encyclopedia Britannica. 2021. Nitrogen Fixation. Online. [https://www.britannica.com/science/nitrogen-fixation. [Accessed 22 March 2022]..

Today, however, the most dominant and economical way of producing ammonia on an industrial scale is done via the “Nitrogen Fixation Process” (NF process), historically known as the Haber-Bosch process. Discovered in 1909 by Fritz Haber, and later demonstrated on an industrial scale in 1913 by Carl Bosch, the process is the direct synthesis of ammonia from hydrogen and atmospheric nitrogen7 Chen et al S. 2019. Chapter 2 – Electrochemical Dinitrogen Activation: To Find a Sustainable Way to Produce Ammonia. Studies in Surface Science and Catalysis 178: 31-46:

N2(g) + 3H2(g) ⇌ 2NH3(g)

The NF process is conducted at high pressure and at a temperature of around 450°C in the presence of an iron catalyst. The conversion of hydrogen and nitrogen to ammonia in the reactor only amounts to ~15% per completed round, however, unreacted gases are continually recycled to achieve an overall final conversion of ~98%8 Clark J. 2013. The Haber Process. Chem Guide. Online. [https://www.chemguide.co.uk/physical/equilibria/haber.html.]. The gaseous product is then condensed into liquid ammonia.

Hydrogen production

Contrary to the older ammonia production pathways, the NF process uses hydrogen as a reactant. While nitrogen can be extracted from the ambient air, hydrogen is produced on industrial scale. There currently are three main pathways for hydrogen production, which confer it various “degrees of sustainability”.

Most of the hydrogen produced globally today is manufactured from steam methane reforming. This produces syngas, a mixture of mainly hydrogen and carbon monoxide, from which hydrogen can be extracted. Although part of the carbon monoxide by-product can be further reacted with water to produce more hydrogen9 U.S. Department of Energy. 2021. Hydrogen Production and Distribution – Alternative Fuels Data Center. Online. [https://afdc.energy.gov/fuels/hydrogen_production.html#:~:text=There%20are%20several%20ways%20to,water%20to%20prod uce%20additional%20hydrogen] , large quantities of CO2 are emitted by the process. In addition, it is mostly powered by fossil energy, which adds to the total GHG emissions tally. This pathway results in the production of what is called grey hydrogen (Fig 1).

To reduce CO2 emissions, carbon capture and storage (CCS) technology can be added to the steam methane reforming step of the process. When this change is applied, the resulting product is called blue hydrogen10National Grid. The hydrogen colour spectrum. Online. [https://www.nationalgrid.com/stories/energy-explained/hydrogencolour-spectrum] (Fig 1). CCS is the only change applied in this case. Here, the processes are still powered with fossil energy.

The third, and most sustainable alternative, uses a different process to produce hydrogen: water electrolysis. Here, an electrochemical reaction splits water into its constituents of hydrogen and oxygen, without releasing any carbon dioxide as by-product of the reaction11xi Office of Energy Efficiency & Renewable Energy. Hydrogen Production: Electrolysis. Online. [https://www.energy.gov/eere/fuelcells/hydrogen-production-electrolysis] . In addition, the production pathway is powered by renewable energies. This entire production pathway yields what is referred to as green hydrogen (Fig 1). Only a very small proportion of current global hydrogen production uses this technology.

Figure 1. Pathways of hydrogen production

Green ammonia

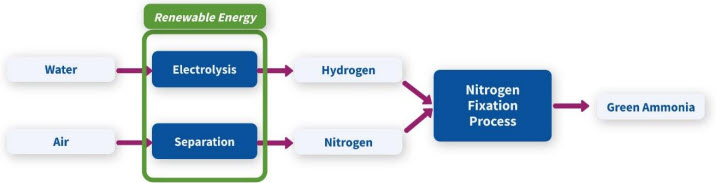

To qualify as “green”, ammonia first has to be produced from green hydrogen. In addition, the nitrogen used in the process must be extracted from the ambient air using separation technology powered by renewable energy. Making it “green nitrogen”. Once these criteria have been met, the NF process can go ahead to produce the ammonia, using renewable energy as power source. Only when all of these criteria are met can the resulting product be called “green ammonia” (Fig 2).

Ammonia production leads to annual GHG emissions close to 500 million tonnes, amounting to nearly 1.8% of global CO2 emissions. Of these, 80% are directly linked to the hydrogen-producing process of steam methane reforming.12 Royal Society. 2020. Ammonia: zero-carbon fertiliser, fuel and energy store. Online. [https://royalsociety.org/- /media/policy/projects/green-ammonia/green-ammonia-policy-briefing.pdf]

Figure 2. Green ammonia production. Diagram adapted from The Royal Society’s “Ammonia – zero-carbon fertiliser, fuel and energy store” policy briefing

Ammonia-derived fertilisers

Ammonia has multiple uses, including refrigeration, chemical manufacture and waste purification. However, as much as 80% of all ammonia production goes directly into the manufacture of agricultural fertilisers13New York State Department of Health. The Facts About Ammonia – How is ammonia used? Online. [https://www.health.ny.gov/environmental/emergency/chemical_terrorism/ammonia_tech.htm#:~:text=About%2080%25%20of %20the%20ammonia,pesticides%2C%20dyes%20and%20other%20chemicals].

The annual global supply of ammonia is estimated to be around 180 million tonnes. China is the country that produces and consumes the largest portion of global ammonia supplies. In 2019, the country produced around 48 million tonnes14 Forbes. 2021. Scaling ammonia production for the world’s food supply. Online. [https://www.forbes.com/sites/mitsubishiheavyindustries/2021/10/29/scaling-ammonia-production-for-the-worlds-food-supply/] . The next biggest producers are Russia, with a 12.5 million tonnes annual production capacity, and India, which currently produces 11 million tonnes per year. Despite their negative environmental effects, ammonia and N fertilisers significantly impact crop yields within the framework of current agricultural practices. In a world inhabited by 7.6 billion people, soon to reach as much as 9 billion, food production is likely to become even more of a challenge. Optimising yields is, and will remain, a priority. Therefore ammonia-based fertilisers will continue to be produced in evergrowing quantities.

In 2021, the global green ammonia market was estimated at $17 million, which pales in comparison to the $125 billion global N-fertiliser market. However, interest in green ammonia is expected to take off, and its market is forecast to reach around $5.4 billion by 203015 Markets and Markets. 2022. Green Ammonia Market by Technology (Alkaline Water Electrolysis (AWE), Proton Exchange Membrane (PEM), and Solid Oxide Electrolysis (SOE)), End User (Transportation, Power Generation, and Industrial Feedstock), and Region – Global Forecast to 2030. Online. [https://www.marketsandmarkets.com/Market-Reports/green-ammonia-market118396942.html]. This is very much tied to the world’s decarbonising efforts. Many countries have now pledged to decarbonise their industries, and their energy by 2050. The sustainability of ammonia being so linked to the energy used to power processes, energetic decarbonisation is likely to lead to a larger supply of green ammonia. A lot of the strategies being drawn out have intermediate 2030 milestones with ambitious emission reduction targets, it is then likely that the supply of green ammonia will have reached new heights by that same year.

Industrial stakeholders are also taking steps to accelerate the transition. In January 2022, Yara Norge – one of the world’s biggest producer of fertiliser – contracted Linde Engineering for the construction of a 24MW electrolyser. The new unit will be used to produce green hydrogen which will in turn be used to manufacture green ammonia. The sustainable ammonia will then be used to producer fertilisers16 S&P Global Community Insight. 2022. Linde Engineering wins 24 MW electrolyzer order from Yara Norge. Online. [https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/electric-power/012822-linde-engineering-wins24-mw-electrolyzer-order-from-yara-norge] . Although national policies are promoting the decarbonisation of energy, most of the progress done for the transition towards green ammonia has been done by the industry

Ammonia-based fuels

Transport is currently responsible for 20% of global CO2 emissions (equivalent to around 8 billion tonnes of CO2 emitted annually), with maritime shipping representing nearly 11% of that share17Our World in Data. 2020. Cars, planes, trains: where do CO2 emissions from transport come from? Online. [https://ourworldindata.org/co2-emissions-from-transport]. In their efforts to decarbonise their economies, several nations around the world are implementing biofuel incorporation quotas in transport fuel blends. Biofuel quotas for passenger cars and HGVs have also come into force, with bioethanol, bio-LNG and biodiesel (to name a few) occupying an ever-increase space in global fuel supplies. Sustainable aviation fuels (SAF) are already becoming a staple of the aviation industry, with an increasing number of large global companies having made them an integral part of their businessxix.

Maritime shipping has, so far, remained behind in terms of low-carbon fuel and biofuel incorporation, however, following the 2018 pledged from the International Maritime Organisation to halve GHG emissions by 2050, ammonia is now being put forward as a potential gamechanger for the sector18IEEE Spectrum. 2021. Why the shipping industry is betting big on ammonia. Online. [https://spectrum.ieee.org/why-theshipping-industry-is-betting-big-on-ammonia]. The benefits of using ammonia as fuel include a high volumetric energy density compared to other alternatives such as hydrogen and methanol, and fairly easy storage conditions, which would make onboard stocking economically and logistically feasible. Unlike current oil-derived fuels used in the industry, conventional ammonia does not release any GHG when combusted. It could, therefore, become a low-carbon fuel solution. One big caveat remains that current ships are not equipped to be able to use ammonia as fuel. Adopting it would require major (and costly) infrastructure changes, including the purchase of new ships, and relevant fuel production facilities.

Despite these significant hurdles, trials are currently underway and ammonia-powered ships have already successfully taken to sea. In June of 2022, the Maritime and Port Authority (MPA) of Singapore entered into a deal with multiple other maritime stakeholders for the design of an ammonia dual-fuel tanker. The ship will be built by partner Hyundai Heavy Industries, and is expected to sail under the Singapore flag19Argus. 2022. Singapore’s MPA partners on ammonia-fuelled tankers. Online. [https://www.argusmedia.com/en/news/2339087-singapores-mpa-partners-on-ammoniafuelled-tankers]. Although the transition towards ammonia-powered fleets is expected to take years, the maritime sector appears to be putting a lot of faith and investment in this new form of fuel. By 2050, oil based maritime fuels are expected to drop by 50%, while ammonia and hydrogen-based solutions should increase by nearly 30%.

Figure 2. Projected fuel usage in the maritime shipping sector up until 2050

Although ammonia combustion does not produce GHG, emissions occur during ammonia production. As a result, using green ammonia as shipping fuel would be the better solution from a sustainability standpoint. As there is no chemical and mechanical difference between conventional ammonia and green ammonia, ships able to operate on conventional ammonia will be able to operate on green ammonia. Switching from on to the other is not an issue in itself. However, adopting green ammonia would be subject to major supply issue: not only is conventional ammonia production mainly used for fertiliser production (making its supply limited for other purposes), green ammonia production as a whole remains extremely limited. Once the share of the production dedicated to fertiliser manufacture has been allocated, not a lot, if at all, is left for fuel production.

To tackle this supply issue, one of biggest players in the maritime industry – Maersk – is backing the construction of the biggest green ammonia production plant in Europe. The plant, located in Denmark, will use electricity produced by wind turbines to power the ammonia production process. Maersk, and a number of other partners, will support the construction of the plant and will help with its commercial development by becoming key off-takers (both for fertiliser production and maritime shipping)20 MAERSK. 2021. Maersk backs plan to build Europe’s largest green ammonia facility. Online. [https://www.maersk.com/news/articles/2021/02/23/maersk-backs-plan-to-build-europe-largest-green-ammonia-facility].

Conclusion

Green ammonia is a promising resource which could benefit a range of sectors, from food production to transportation. Although transitioning towards green ammonia is not one of the main international sustainability targets, other more public goals and campaigns will most definitely indirectly promote it. As nations continue to strive for decarbonised economies, electricity will become greener, so will industrial processes, and so will ammonia.

The prospect of clean ammonia production is very positive and will lead to significant reductions in greenhouse gas emissions. However, these reductions will only apply to the ammonia production chain. Green ammonia will remain an environmental issue if used improperly. As touched upon in the previous article of this series, N-based fertilisers (whether made from conventional ammonia or green ammonia) can have serious consequences on ecosystems and on global warming as a whole when not applied properly. Nitrogen excess in soils can lead to water eutrophication and nitrous oxide emissions, for example. In addition, nitrogen is known to lead to the mineralisation of carbon in soils, rendering it unavailable to organisms. As a result, understand soil and crop N needs is essential to optimising carbon cycling and to promoting yields. Such better understanding could also lead to a drop in N-fertiliser need, which would in turn make more ammonia available to the maritime shipping sector, which could in turn accelerate its defossilisation efforts.