The production of biobased chemicals is widely seen as a novel

and emerging endeavour. There is a great deal of discussion and focus on the

development of disruptive technologies such as the use of industrial

biotechnology supported and enhanced by synthetic biology. Synonymous with novel

technologies are the disruptive innovators, typically small or medium

enterprises (SMEs) looking to meet the demands of new or market segments

overlooked by incumbents.

In the biobased chemicals industry there is no shortage of

innovative companies. Established biobased product producers such as

Natureworks and Novamont are driving new application development. New processes

are being developed by numerous innovators including Avantium, Global

Bioenergies and Genomatica. Additionally the speed of biotechnology innovation

is increasing through the enabling capabilities of companies like Twist Bioscience and Ginko Bioworks.

However these are not

the widely recognised behemoths of the chemical industry. So how are the giants

of the chemical industry reacting to the perceived demand for green or

sustainable chemicals and specifically the increasing market demand for biobased

chemicals?

A review of the 2020 ICIS Chemical Business list of the Top 100

chemical companies[1] showed that over 70% have some research or business interest in the biobased

chemicals area. However, an interest does not necessarily equate to activity.

Each month NNFCC captures, collates, and

publishes a summary of company announcements covering biobased products. To

review biobased activity by these top 100 companies we looked back at our

monthly NNFCC news reviews carrying announcements on biobased products during

2020 and 2021. These views capture topical industry news and although not comprehensive,

we feel they are a fair reflection of activity.

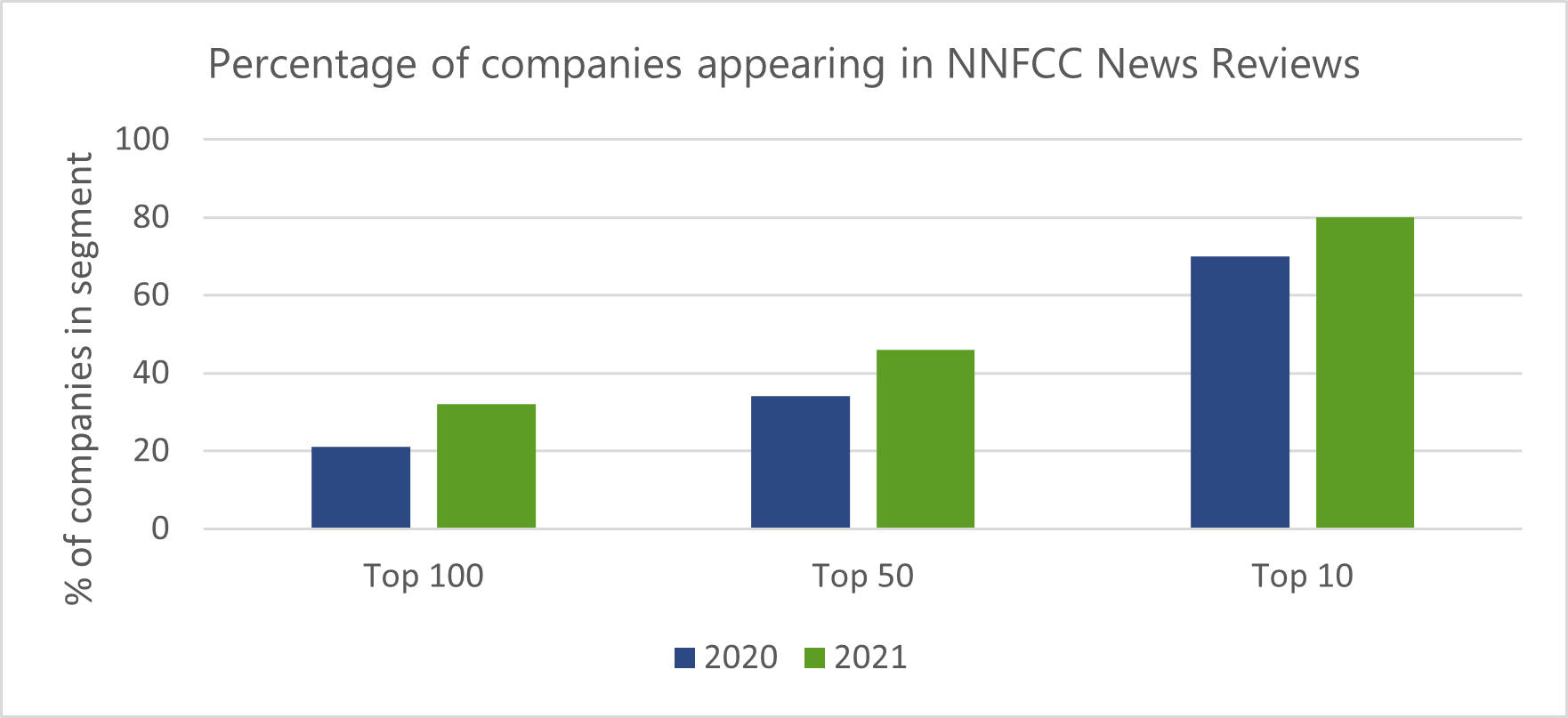

This simple analysis indicates that companies higher up the Top

100 list are more likely to have made an announcement about a biobased

development (Figure 1).

In 2020, 21 of the top 100 chemical companies had entries in the

news reviews and this increased to 31 in 2021. This relatively low (although

increasing) reflection of activity across the top 100 companies is in contrast

with the level of activity seen in the Top 10 companies. Of these companies, 7

appeared in the 2020 news reviews, increasing to 8 in 2021. Of the Top 50

companies, 23 featured in the 2021 news reviews up from 17 in 2020.

Figure 1. Percentage of top chemical companies appearing in

2020 and 2021 NNFCC Biobased Product News Reviews.

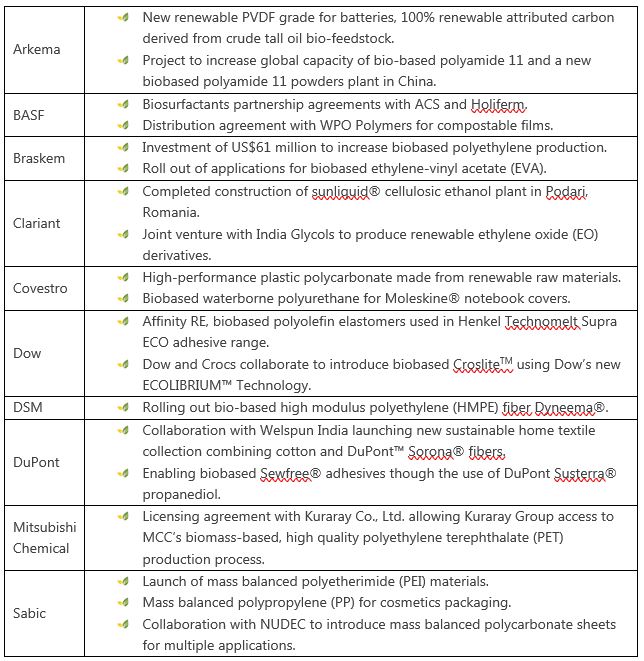

Of the companies to showing high levels of activity in 2021, 10

companies featured three or more times in the news reviews (Figure 2).

Figure 2. Top 100 companies featuring three of more times

in 2021 NNFCC Biobased Products News Reviews.

These companies represent a broad range of industrial and market activity

but one theme that ran through many of the announcements was the use of mass

balance approaches to attribute renewable content to products. This is to be

expected from large companies with established product lines, mature supply

chains and considerable capital invested in production facilities. Announced renewable

materials provided through mass balance programmes included polyolefins, polyvinylidene

fluoride, elastomers, and polycarbonates.

Other areas of development included an expansion in biobased

polyethylene production, new investments in biosurfactants, the roll out

biobased ethylene-vinyl acetate and the use of biobased chemicals in textile

applications. Some selected announcements are shown below.

Whether in SMEs or large multinational companies there is evident

interest and increasing activity in the development and supply of biobased

chemicals and materials. Both dedicated production and mass balanced approaches

are being pursued to produce drop-in molecules as well as new to market

molecules such as novel biosurfactants.

How the industry continues to evolve will depend to large extent

on the sustainable feedstock supply, whether for dedicated production or in

mass balanced approaches. Given the considerable scale of the chemical industry

and the demand potential for renewable feedstocks via mass balanced applications

it will be interesting to see what volume of production this approach can achieve.

The regular monitoring of biobased chemical industry

announcements is part of range of activities undertaken by NNFCC to maintain the

knowledge base that underpins our client work in market analysis,

sustainability assessment and, business planning and opportuning appraisal.

[1] ICIS Chemical Business,

3-9 September 2021, accessed 06 July 2022, https://s3.eu-west-1.amazonaws.com/icis.ada.website.live/wp-content/uploads/2021/09/13164728/ICB_030921_Top-100-Chemical-Companies-pt-1-1.pdf.