On the 29th of June, the UK Department for

Business, Energy & Industrial Strategy (BEIS) released the country’s

quarterly electricity data, indicating both the capacity for electricity

generation from various sources, and the actual level of generation that has

occurred. These data (and attached statistics) aren’t widely publicised, so

here follows a summary of how bioenergy holds up in the UK’s electricity

generation picture.

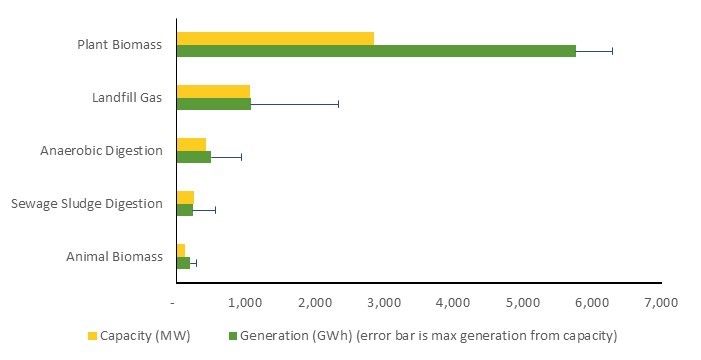

We define Bioenergy as an umbrella term for the following

five electricity sources featured in the data: Sewage Sludge Digestion, Landfill

Gas, Animal Biomass, Anaerobic Digestion and Plant Biomass. In terms of both

capacity and generation, biopower generation is heavily dominated by plant

biomass, which, at nearly 3GW of capacity, accounts for over 60% of the UK’s

bioenergy infrastructure, and over 75% of its generation.

Since last quarter, there has been an increase of nearly 20%

in generation from the bioenergy sector, which is lower than for renewables as

a whole, but since total UK electricity generation remained approximately the

same as last quarter (an uncommon occurrence, as Q1 tends to be the

highest-generation quarter, due to more demand during the darker months), this

is a good sign. Comparing to the same quarter last year, bioenergy capacity has

increased by nearly 5%, a rise driven by Anaerobic Digestion and Plant Biomass,

both of which have seen capacity increases of over 50MW (which is a bigger deal

for AD – this amount equates to a 15% increase in capacity). Despite this, power

generation from AD is down approximately 8.5% on last quarter, with output from

all other bioenergy sources being up by around 20%. Although relative increases

are good to assess a technology’s progress in development, it should be noted

that Plant Biomass’ dominance is still very much evident when looking at the

real increases – generation is up by over 1TWh on last quarter.

Stable Trends

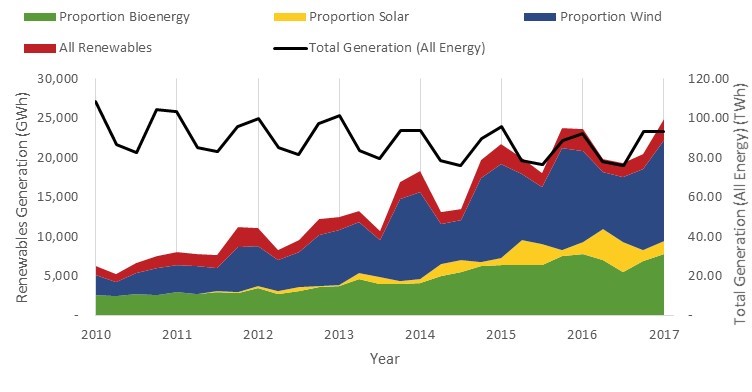

The data also reveal trends in bioenergy since 2010, which

offers long-term insight into where the bioenergy piece fits in the renewables

puzzle. In 2010, bioenergy’s contribution to the UK’s total electricity

generation was 1.5%; in the ensuing 7 years this has risen to 8%. This increase

is in keeping with increases in renewables as a whole, as evidenced by

bioenergy’s share of renewable generation remaining reasonably consistent, at

around 15%.

The makeup of the bioenergy sector also has a noticeable

bearing on how each technology has developed over the time period covered in

the data. Anaerobic Digestion, for example, which is a sector built around many

small-scale plants, has seen consistent levels of growth since 2010, as new

plants pop up all around the country. Compare this with the plant biomass

sector, which is dominated by large scale producers such as Drax, and thus sees

more sporadic increases in capacity, but these are of far greater magnitude

than anything experienced in the other sectors. One example of this is Drax setting

about converting their coal stations to burn wood pellets. In terms of generation,

all of the individual sub-sectors within bioenergy have remained reasonably

consistent in their increases, with the notable exception once again being

Plant Biomass, which, in line with big capacity increases, sees large, stepped increases

in its generation, with no significant relative growth in the meantime.

One thing that sets bioenergy apart from other

renewables such as solar and wind power is the comparative lack of external

factors that influence generation. Bioenergy Load Factors are always higher

than for renewables as a whole, and also do not suffer from the seasonal

fluctuations seen in solar and wind. This indicates that while other renewables

are slated to bring the majority of renewable electricity both at present and

in future, bioenergy can be the solid foundation upon which a renewable

electricity industry can grow and flourish.